42% of European Businesses Plan to Increase Investment in Vietnam

At least 42% of European businesses in Vietnam said they would increase their investment capital by the end of 2022, despite confidence being dampened by the uncertainty of the global economy.

Recently, in a survey by the European Chamber of Commerce in Vietnam (EuroCham), the Eurocham Business Climate Index (BCI) of European businesses in Vietnam, which was published by YouGov Decision Lab, declined for the second consecutive quarter at 62.2 percentage points, decreased by 6.4 percentage points from Q2 and decreased by 10.8 points from Q1/2022.

“This is a time when global economic conditions remain volatile due to the escalating conflict in Ukraine, persistent inflationary pressures, global labor shortages and slow growth,” said the EuroCham report.

Obviously, the BCI results for Q4 of this year have shown that the confidence of European businesses has decreased slightly. Only about 42% of survey respondents predict that the economy will stabilize or improve in Q4 of 2022. This is a decrease of 18 percentage points from the first quarter of this year. Similarly, the rate of those predicting a recession rose 7 points to 19%.

“The decline in the BCI may reflect the instability of the Vietnamese economy, although it is still seen as a positive indicator of growth as the country is recovering,” the report said.

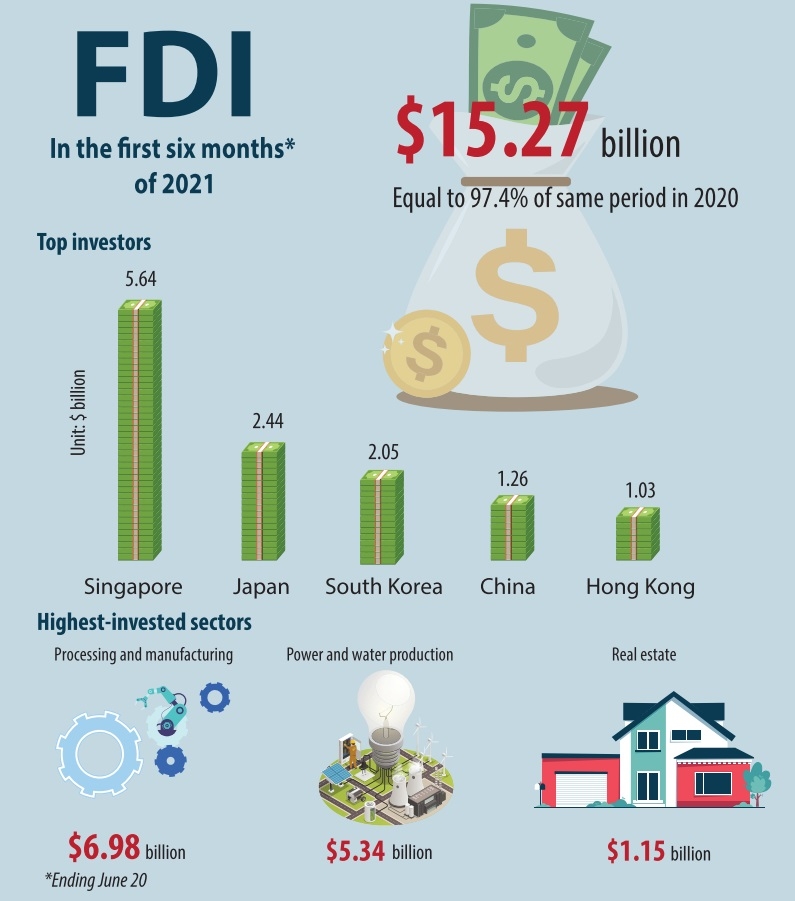

However, in terms of foreign direct investment (FDI), the report found that 17% of enterprises surveyed said that they had moved at least part of their operations from China to Vietnam, reflecting the change in the supply chain more widely with some enterprises choosing the "China plus one" strategy. Among them, up to 59% of surveyed enterprises said that their company's FDI in Vietnam may increase to some extent.

At the end of September, the European Union Chamber of Commerce in China, with a group of more than 1,800 companies, expressed a negative view of China's anti-pandemic policy. In particular, up to a quarter of companies consider moving current or planned investments out of China, the highest percentage in the past decade.

In fact, China's "inflexible and consistent" anti-pandemic policy has been crippling the business activities of foreign enterprises including European ones and also creating opportunities for foreign investors from other countries, including Vietnam.

However, also in the survey by EuroCham, the key to increasing the level of FDI in Vietnam also means that Vietnam must consider minimizing administrative procedures and promoting infrastructure development. This is followed by improved human resource capacity, making it easier for foreign professionals to obtain visas and lower tax rates for foreign companies.

“Vietnam can increase this level of FDI by reducing administrative difficulties (68%), improving infrastructure (53%), developing human resource capacity (39%) and reducing market barriers for foreign experts (39%),” the report said.

“Vietnam offers great investment opportunities for European businesses and we are excited about the country's prospects in the medium and short term. Through the EU-Vietnam Free Trade Agreement and our shared commitment to sustainable development, Vietnamese and European companies have a lot of growth potential,” EuroCham President Alain Cany commented.

Meanwhile, CEO of YouGov Decision Lab, Thue Quist Thomasen also appreciated Vietnam's potential. “By curbing inflation, improving credit ratings and continuing to grow GDP, Vietnam’s story becomes less pessimistic globally,” he said. BCI in Vietnam declined, but this is still above average, showing that businesses are still optimistic about future development prospects.