Business community leads call to action for authorities

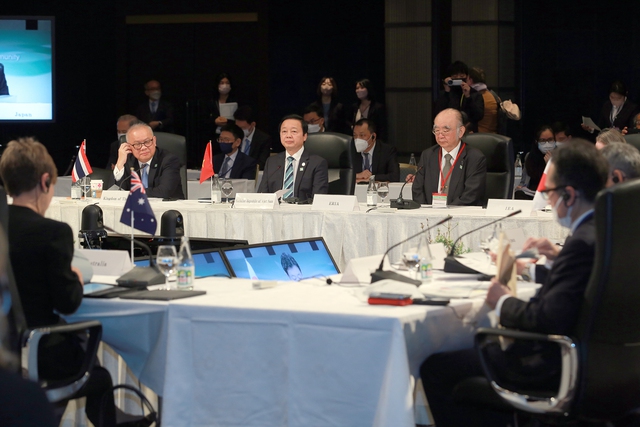

Significant focus was placed on revitalising the economy, smoothing out tax issues, and ensuring a green transition at last week’s Vietnam Business Forum.

During Sunday’s Vietnam Business Forum (VBF) in Hanoi, everything from the foreign labour situation and digital tax to combating climate change was discussed by the various participants, which included heads of influential international organisations.

Arguably the most vital near-term issue according to those involved is power shortages being felt in some areas of the country. The Japan Chamber of Commerce and Industry (JCCI) said that northern industrial zones are being particularly affected, and it wants to see the nation’s Power Development Plan VIII to officially come on board as soon as possible.

“In recent years, Japanese corporations have expanded their footprint in Vietnam to capture the great demand for renewable energy. But it is challenging for domestic businesses and financial institutions to independently execute large-scale power generation projects, such as gas and offshore wind power,” the JCCI noted.

“We hope that local governments quickly modify the present legal corridor on investment and public-private partnerships. Next, the government should rapidly disseminate the direct power purchase agreement (DPPA) mechanism for the renewable energy segment,” it added.

The European Chamber of Commerce in Vietnam (EuroCham) also suggested that the Vietnamese government should change the contract between Electricity of Vietnam and clean energy producers to meet international standards and get the full cost-cutting benefits of the planned auctions in exchange for full take-or-pay provisions.

“We should give people who use electricity the access to clean energy by using DPPAs in pilot projects and lowering the regulatory barriers in front of clean energy plants behind the meter,” the chamber said. “In addition, we should also expand pilot projects and encourage private investment in the power transmission network, and allow investors who meet the requirements to build 220kv and 500kv transmission lines to do so on their own.”

Furthermore, offshore wind power development should be prioritised, and storage on-site with solar power should be permitted, it said.

The VBF’s Power and Energy Working Group agreed, stating that if there is an appropriate legal framework for offshore wind power, Vietnam could attract billions of US dollars in investment capital for these projects and supply materials, thus generating a huge amount of revenue and bolstering economic growth.

In terms of the wider energy transition, the Korea Chamber of Business in Vietnam (KoCham) believes that the Just Energy Transition Partnership signed late last year could facilitate Vietnam’s switch to a greener future.

“South Korea wants to support Vietnam’s net-zero 2050 goal by providing advanced technologies and qualified experts to accelerate the peaking of its greenhouse gas emissions, and transition from fossil fuels to clean energy,” KoCham said.

However, it is necessary to convert four coal power plants under construction to using fuel and to alter their business rights, which necessitates the approval of the Vietnamese government. “This category also includes coal-fired power projects that are being constructed by South Korean companies. Thus, we suggest the Vietnamese government actively support South Korean projects to make the transition to renewable energy smoothly,” it added.

Wider financial implications

Meanwhile, the VBF’s Environment Working Group said that, in accordance with Vietnam’s legal framework, domestic and foreign investors with access to foreign financial resources are required to work with a local bank. As a result, the costs for foreign funds wishing to invest and support Vietnam’s low-carbon economy are increased to the point where they are sometimes uneconomical.

“There is no regulation from the State Bank of Vietnam or the Ministry of Finance to aid the green finance sector through carbon tax recycling, emission restriction, environmental protection tax, other sources of budget revenue; or the establishment of green financial funds,” said the working group.

Moreover, it is presently unknown which ministry or agency would administer or finance such a fund or green initiative. “The absence of clarity in Vietnam is frequently interpreted as a lack of approval by the private sector and foreign investors. Thus, a set of policies to manage green investments could be a crucial milestone to accelerate climate finance development in Vietnam,” the Environment Working Group noted.

Foreign funds coming to Vietnam will also be affected depending on how the country deals with the upcoming global minimum tax. EuroCham’s Tax Committee raised its concerns at the VBF over the introduction of the 15 per cent rate via Pillar II, which could negatively impact the retention and attraction of foreign funds to Vietnam as local tax incentive policies may no longer be a key competitive advantage.

“As such, Vietnam should work together with other developing countries to negotiate reservations/exceptions to protect tax incentives for foreign investors in terms of particular industries, such as labour-intensity and technology transfer to modernise economic development,” the EuroCham representative said. “Additionally, Vietnam should negotiate with the relevant home countries of the foreign investors to sign bilateral agreements not to apply for Pillar II for particular ventures.”

Another concern for many is the taxing of international suppliers operating on digital platforms are among the urgent concerns, as brought up by the American Chamber of Commerce in Vietnam (AmCham).

The regulations guiding overseas suppliers to directly register, declare, and pay tax in Vietnam remain vague, resulting in compliance difficulties, the chamber said.

“Circular No.80/2021 provides that taxable revenues are “revenues that foreign suppliers received” which has a very broad connotation and does not reflect the true nature of the revenues arising from e-commerce activities and digital-based business in Vietnam of foreign suppliers,” AmCham stated. “If a foreign e-commerce platform must declare taxes on the entire revenue collected on behalf of the foreign seller on top of what the foreign seller is also declaring, it will lead to double taxation as both parties are declaring tax on the same amount. To align with international best practices in order to ensure fairness and no double taxation, Circular 80 should be amended to clearly stipulate that taxable revenues are the actual revenues that foreign suppliers earned, which is revenues relating to their own sales only.”

Efficient reform

Regarding digital tax for foreign companies, the VBF’s Tax and Customs Working Group highlighted that although the e-portal for tax payment of cross border activities for the registration, reporting, and payment of taxes by foreign providers became operational in early 2022, tax officials have yet to process or give a written notice focusing on the double taxation avoidance (DTA) agreement for tax exemption of foreign providers in Vietnam.

The Ministry of Finance and the General Department of Taxation should issue clear guidelines to prevent double taxation as soon as possible, the tax working group said. Moreover, Vietnam should consider allowing e-commerce platforms to apply for the DTA pact on the basis of general terms of service for each business model, which is more efficient than a specific dossier for each transaction.

Since March 2022, when cross-border businesses in Vietnam started to declare and pay taxes, authorities have only collected around $145 million from 42 companies. Of these, six major foreign corporations including Google and Microsoft account for 90 per cent of the market share in revenue of e-commerce services and cross-border digital platforms in the country.

The Tax and Customs Working Group also pointed out a specific case regarding tax issues at Binh Duong Private General Hospital, a member of Hoan My Hospital Group.

“There have been problems with the late payment of corporate income tax (CIT) declared and additionally paid, and we suggest the General Department of Taxation review this case and provide guidance on how to calculate the late payment penalty of CIT which has been declared and paid in accordance with Circular 71,” said the group.

With various foreign representatives present at the VBF, the event was never going to avoid the conversation around current challenges in issuing work permits and visas.

Representatives of the VBF’s Human Resources Working Group said that competent Vietnamese authorities should provide detailed guidance on which cases can apply for a work permit under the category of foreigners working in Vietnam as managers, executives, experts, or technical workers, and how this category is distinguished from that of foreigners working under labour contract or internal transferees.

At the same time, EuroCham urged for an overhaul in visa exemption. “We urge that the government and competent authorities expand the visa exemption policy to all EU countries, along with a clear roadmap and a transparent process, in order to implement this policy,” the representative said.

In particular, EuroCham suggests granting a visa-free visa with a 14-day validity that may be extended to a maximum of 21 days, or obtaining a visa at the airport for a price of no more than $20 per person.

The Australian Chamber of Commerce in Vietnam (AusCham) concurred with the proposal to exclude Australian passport holders from visa requirements for short-term tourist entry/exit and transit through Vietnam, similar to 25 other countries.

AusCham stressed, “It is of utmost importance to revitalise the tourism segment in order to enhance visitors’ spending, which might bring a large benefit to Vietnam as a whole.”