Changes required for Vietnam to lure more foreign capital

(VEN) - Vietnam has done well in attracting foreign direct investment (FDI), but the country needs to make changes to lure more high-quality foreign capital.

Attractive investment destination

Vietnam is currently the third largest receiver of FDI in the region. In 2021, foreign investors registered to invest more than US$31 billion in Vietnam, a year-on-year increase of over nine percent. In the first four months of 2022, Vietnam attracted US$10.8 billion in FDI, with the southern province of Binh Duong taking the lead with US$2.3 billion, followed by the northern province of Bac Ninh with US$1.6 billion, and Ho Chi Minh City with US$1.3 billion.

Many localities have adopted specific mechanisms and policies to facilitate enterprises in their investment, such as simplifying administrative procedures and strengthening on-site investment promotion activities.

The latest Business Climate Index (BCI) of the European Chamber of Commerce in Vietnam (EuroCham) increased to 73 points in the first quarter of 2022, up 12 points compared to the fourth quarter of 2021. The BCI is expected to improve further in the second quarter of the year as more than two-thirds of surveyed companies expressed optimism about strong economic recovery.

Prof. Nguyen Mai, chairman of the Vietnam Association of Foreign Invested Enterprises (VAFIE), said Vietnam has paid special attention to providing support for investors and helping businesses overcome difficulties. To effectively attract and maintain foreign investment in Vietnam, the country needs to adopt stricter management policies and encourage FDI projects capable of creating spillover effects on the economy and helping domestic businesses participate more deeply in global value chains.

Vietnam gives top priority to attracting high-quality foreign capital

High-quality, long-term foreign capital

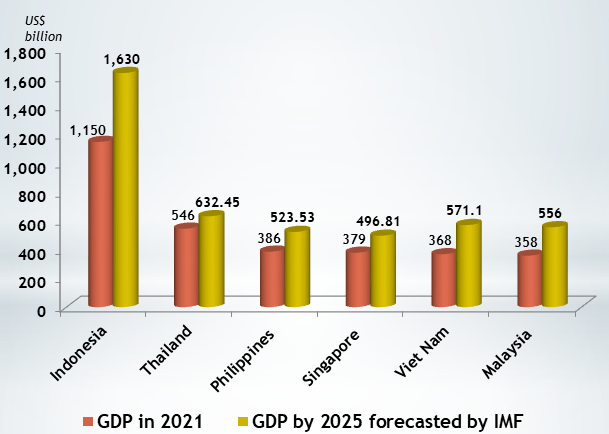

Vietnam targets attracting foreign investments of US$150-200 billion in the 2021-2025 period and US$200-300 billion in the 2026-2030 period, while aiming at US$100-150 billion and US$150-200 billion in realized capital in the respective periods. The ratio of businesses using advanced technologies and implementing modern governance without harming the environment is expected to increase by 50 percent by 2025, while the percentage of trained laborers is expected to reach 70 percent. Economists believe the goal is feasible given Vietnam’s macroeconomic stability, increasingly improved business and investment environment and growing middle class.

Bruno Jaspaert, general director of the DEEP C Industrial Zones, said Vietnam need not compete with China, focusing instead on its own strengths. Logistics costs in Vietnam are among the highest in Southeast Asia, hampering investment attraction. Therefore, Vietnam needs to make significant changes to reduce these costs, improve its business and living environment, develop more services and bolster trading activities.

Pao Jirakulpattana, vice president of Singapore’s Warburg Pincus, said that amid global uncertainties, investors lack choices. He predicted that the focus will turn to supporting the long-term growth needs of key economic sectors, adding that Vietnam should pay special attention to developing key economic sectors and maintaining its attractiveness to promote investment attraction.