FDI companies dominate leather, footwear exports

(VEN) - The Vietnamese leather and footwear sector is expected to draw new orders resulting from the shift of manufacturing facilities of major brands. However, domestic companies will not benefit from this growth in order if they do not improve their capabilities.

FDI companies account for most exports

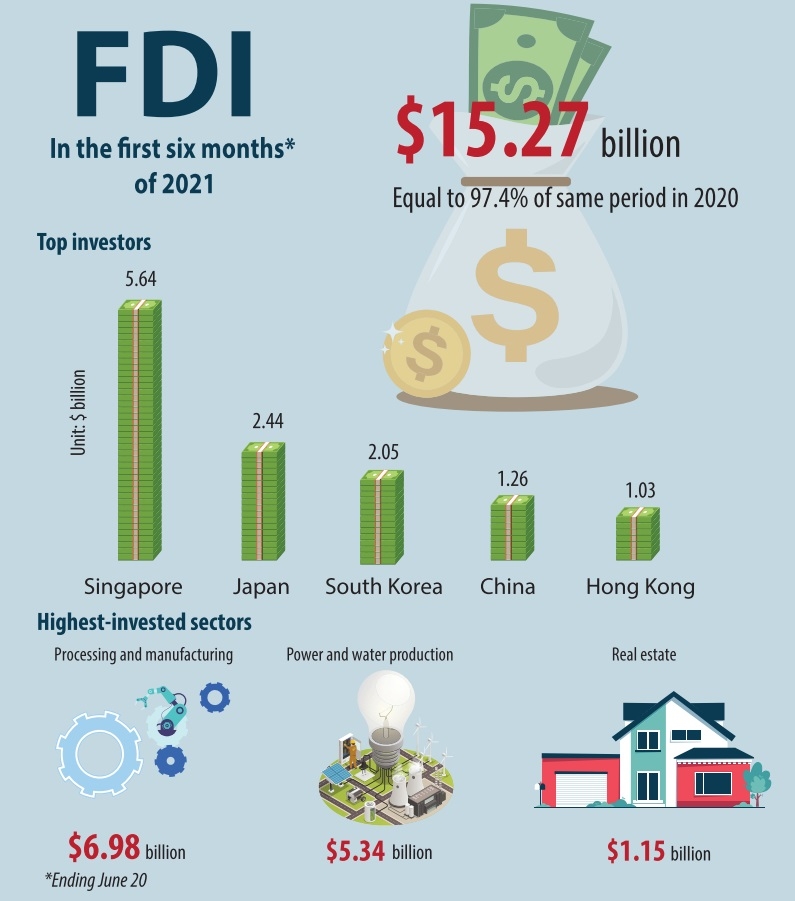

Ministry of Industry and Trade data show that in the first quarter of 2021, the export value of Vietnamese footwear grew 13.5 percent compared with the same period last year, reaching US$4.74 billion. Although this was an encouraging result in the context of Covid-19, Phan Thi Thanh Xuan, Vice President of the Vietnam Leather, Footwear and Handbag Association, said the export growth did not reflect the “health” of domestic companies as 80 percent of exports were produced by firms with foreign direct investment (FDI). Only a small number of Vietnamese companies have the required skills and capabilities to provide outsourcing for sports shoes manufacturers producing major brands such as Nike and Adidas, while small-sized enterprises lacking modern technologies, especially those making fashion products, are facing numerous difficulties.

Pham Hong Viet, Board Chair of the Hanoi Rubber Joint Stock Company, said that most fashion footwear manufacturers face numerous difficulties in seeking orders. Moreover, he added, material prices and transport costs have increased continuously since the beginning of this year, whereas the company has maintained previous selling prices, leading to a considerable profit decline.

Regarding the prospects of leather and footwear exports in the second quarter of 2021, Phan Thi Thanh Xuan predicted positive changes due to signs of consumer demand recovery.

Improving domestic manufacturing capacity

The Vietnamese leather and footwear sector is taking advantage of free trade agreements (FTAs) to boost exports. Leather and footwear account for 40 percent of Vietnam’s exports to the EU market. The sector’s exports to Canada and Mexico - signatories to the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) - have grown rapidly (taxes on Vietnamese footwear exports to Canada have been reduced to zero). However, while FDI companies have made good use of FTA preferences to boost exports, most domestic businesses failed to do this due to their inability to satisfy materials’ rules of origin.

The trend of relocating manufacturing facilities from China and elsewhere remains strong, fueled by the perceived risk of concentrating production in one single country. Vietnam is considered a safe destination due to political stability, a skilled workforce, and effective epidemic control.

However, if Vietnamese companies do not invest in improving manufacturing technology and facilities, they will not receive orders. “If domestic companies fail to meet FTA requirements in terms of environment, sustainable development and input materials, as well as technology and human resources, they will not be able to make the most of opportunities, Xuan said.

The Ministry of Industry and Trade prioritizes export promotion activities and support for various sectors, including leather and footwear, to boost exports once the Covid-19 pandemic is controlled.