M&A seekers play it safe amid choppy economic waters

Global geopolitical concerns and rising inflation are impacting cross-border agreements, and as a direct consequence, investors are taking a conservative approach, particularly concerning mergers and acquisitions.

Amid a volatile macroeconomic climate, Singaporean fund CapitaLand Investment is looking for opportunities in emerging economies, including Vietnam and India. Andrew Lim, CFO of CapitaLand Investment, a fund with a strong Asia foothold, said that such markets might grow in significance as businesses seek to fortify supply chain and energy infrastructure in the face of globalisation shocks like the pandemic.

Lim believes that Vietnam, with its plentiful manufacturing, low costs, and highly educated workforce, may offer a lucrative return compared to other markets. He said that the country boasted immense potential and would begin to assume greater importance as a destination for capital and investment.

“We would love to do more in Vietnam, we are already very active in India,” Lim said. “What recent events have told us is that it’s probably dangerous to put all your eggs in one basket, in an era when globalisation is increasingly being put to the test.”

Earlier this year, CapitaLand Development, the development arm of CapitaLand Group and an affiliate of CapitaLand Investment, successfully sold Capital Place, its international Grade A office building in Hanoi, for more than $550 million. This was the largest merger and acquisition (M&A) deal in Vietnam this year so far, ranked by KPMG Vietnam.

Warburg Pincus, a renowned New York-headquartered private equity company, has injected $250 million into Nova Land, one of Vietnam’s property behemoths, to expand the group’s land bank and accelerate the development of Nova Land’s ongoing projects in strategic locations. The $250 million deal is acknowledged as the fourth-largest M&A transaction this year.

Meanwhile, Masan Group is among the most active players in the M&A playground, contributing three out of the 10 most significant deals, as voted on by the Vietnam M&A Forum.

In 2021-2022, Masan sold its whole animal feed subsidiary to Dutch company De Heus Group for between $600-700 million. Additionally, Masan also offloaded 16.26 per cent of VinCommerce to South Korean conglomerate SK Group for a total of $410 million. It also spent $280 million to purchase 85 per cent of tea and coffee retailer Phuc Long.

“Masan has been working in the culinary sector for some time, but to reach customers directly, you must engage the commercial retail sector,” said Danny Le, CEO of Masan Group, at a VIR press conference last week announcing the Vietnam M&A Forum. “It may take us around 5-7 years to start from scratch, and even then, there’s no guarantee of success. Therefore, M&A is the optimal option to compete with other peers.”

Le said Masan boasts a huge database of consumer transactions as it currently owns the largest consumer and retail ecosystem, Point of Life, and recently made a $65 million transaction to acquire a 25 per cent stake in Trusting Social JSC, an AI fintech company.

The strategic collaboration is expected to provide convenient access to personalised fintech solutions for Masan’s consumers by combining its offline-to-online vision with Trusting Social’s ability to democratise financial services.

Meanwhile, National Assembly Economic Committee standing member Phan Duc Hieu said that the current trend in M&A should focus on new value creation instead of conventional market expansion.

“The Vietnamese government is revising three major laws, which will bring a new positive legislative framework to the market,” Hieu said. “In light of macroeconomic headwinds, businesses should ramp up efforts on structural reorganisation and differentiation approaches to navigate any storms.”

Vu Thi Lan, head of Consulting and Valuation at Cushman & Wakefield Vietnam, said that in the context of a tumultuous market, incumbent businesses are warier when looking at any investment options.

“Meanwhile, some new and large-scale real estate projects have been put on hold due to a tight legislative framework and limited credit. Looking on the bright side, the real estate market is cyclical. There will be slack and challenges ahead, but you may also find silver linings with the right strategic plan,” she said.

According to KPMG Vietnam, M&A activity in the country encountered a downturn in 2022 to merely reset to pre-pandemic levels after a surge in 2021. Investors tend to carefully seek potential deals and assets that bring more benefits besides profitability.

The first 10 months of 2022 have logged in $5.7 billion in total, representing a decline of 47.4 per cent as compared to the whole of 2021 or 12 per cent compared to 2020, while the number of deals significantly declined to the previous two years.

Furthermore, the average deal size for a transaction with disclosed value has declined from $31.1 million in 2020 to $16.5 million in the first 10 months of 2022. The overall number of mega deals (deals more than $100 million) concluded over the review period dropped by half, with 13 deals recorded in just the first 10 months of 2022 as compared to 22 deals in the same period of the previous year.

When split down by industry, the most sought-after targets are in consumer discretionaries, industry, real estate, and energy-utilities. Together, the four make for over 60 per cent of the total value in the first 10 months of 2022.

As investors have shifted their attention to developing sectors like these, M&A activity in finance and consumer staples, which were both active in 2021, has slowed down dramatically this year.

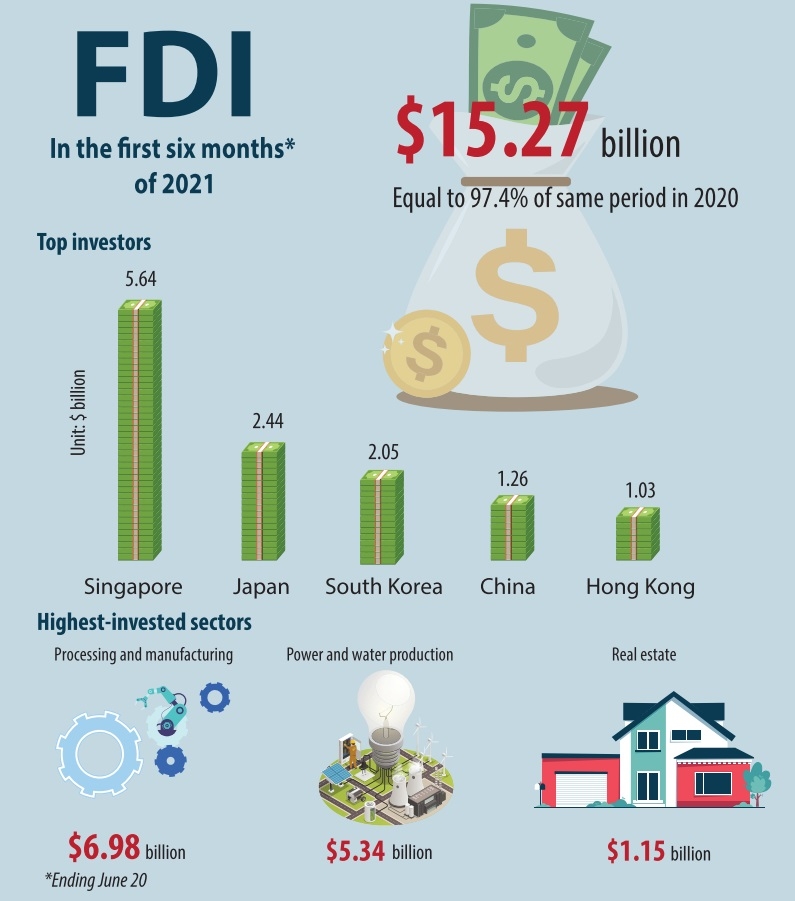

During the past three years, Vietnamese businesses have been the main contributors to the value and quantity of deals in the domestic M&A landscape. Nevertheless, foreign investors from Singapore, the US, South Korea, and Spain have also made substantial contributions.

KPMG observes that due to factors like the pandemic, inflation risk, and price elasticity, the amount of foreign corporations’ investments has fallen below 40 per cent.

With 93 completed M&A deals in the first 10 months of 2022, local investors showed considerable interest in these activities, while other overseas players from Japan, South Korea, and Singapore completed 13 and 15 and 18 transactions, respectively. Local participants contributed $1.3 billion in total deal value, with the second-highest amount of $1.2 billion coming from Singapore, cited KPMG.

|

Phan Duc Hieu - Standing member National Assembly Economic Committee

The policies, either currently revised and newly issued, all have an apparent goal of creating more favourable conditions for enterprises’ production and business activities, including M&A. The National Assembly’s Resolution No.31/2021/QH15 on economic restructuring for the period 2021-2025 aims to bolster the competitiveness and resilience of the local economy. Accordingly, many groups of solutions have been proposed, such as developing different types of markets such as financial market, capital market, bond and securities markets, among others, with the aim of improving efficiency and productivity of each business and the economy as a whole. If the resolution was properly and fully implemented, Vietnam would have a quality economy, creating positive impacts on the capital market, and opening up numerous opportunities for business development, including M&A market development. In this context, the M&A Forum has made a very positive contribution to the economy and state management agencies. The forum raises the awareness on the significance of M&A activities, creating an effective method of raising capital and market expansion. |

|

The 14th annual Vietnam M&A Forum, organised by VIR under the auspices of the Ministry of Planning and Investment, is themed “Igniting New Opportunities” and will take place at the GEM Convention Center in Ho Chi Minh City on November 23. The M&A Forum 2022 will include two major sessions. In the first, titled “M&A Opportunities in Volatile Markets”, presenters will discuss inflation, USD, and other major currency fluctuations and their impact on the pace of M&A activities in emerging markets like Vietnam. In the second session, called “New Value Creation”, renowned dealmakers will delve into how new possibilities can give rise to novel values and look at the drivers of next-generation value. Various experts will also share their insights into the challenges of putting M&A transactions into action, as well as strategies for overcoming those challenges. |

|

Nguyen Viet Khoi - President Institute of Skills, Education, and Creative Intelligence, University of Economics and Business

However, it could be the end of some enterprises if they do not catch up with new trends. The car manufacturing industry is going ahead with electric vehicles (EVs), and Vietnam is following. Manufacturers are focusing on EVs and hybrid models, and in the future, they will dominate thanks to high-tech applications. M&A will follow these trends. In Vietnam, many tech startups are being established. This should be the trend of M&A in technology, especially when such capital mobilisation measures as bonds and loans at banks are tightening. Lan Vu - Manager of Valuation & Advisory Cushman & Wakefield Vietnam

Most transactions came from segments such as rental office, industrial real estate, housing real estate, and hotels. The deals have focused on large markets such as Ho Chi Minh City, Hanoi, and Dong Nai. These transactions were mostly negotiated during the past two years, which is the reason why the number of transactions has seen such an impressive increase during the period. Nguyen Thi Thuy Chung - Deputy director and partner ASL Law

We believe the trend of M&A in retail will have stronger developments. The general difficulties of the Vietnamese and global economies have created pressures on domestic and foreign enterprises. However, with investor confidence and positive changes in business performance, the M&A market next year positive changes. At the M&A Forum 2022, ASL Law hopes to listen to state management units and domestic and foreign groups to receive multidimensional perspectives on the M&A trends in the coming time. It is also a chance to find partners, and learn domestic and foreign consulting firms. Nguyen Kim Hoan - Deputy director, Hanoi branch Viet Dragon Securities

The sectors related to production, import, and export have great opportunities for M&As, especially when China fully reopens. To ensure effectiveness, buyers must be prepared to seize opportunities and enhance potential. The core policy of M&A investment is unleashing the capital market. The state prioritises maintaining macroeconomy stability, so that it proves difficult to achieve policies balancing, such as policies on exchange rate and inflation. The state has plenty of options on policy balancing, such as with exchange rate and inflation. However, in order for decrees and policies to be effective, they require some time to reach genuine enforcement. Trinh Ngoc Duc - Chairman D.lion Media & Solutions

During 2022-2025, M&A capital in fintech will increase. At the forum, we want to meet major businesses. We are also implementing deals with capital flows from overseas. I hope to meet businesses or access capital from abroad to fund future development. Capital is the biggest barrier for SMEs – when receiving capital support from M&A deals, businesses worry they will lose control. The second barrier is lack of access to professional advice. Most businesses are cautious and waiting for recovery. I advise startup to focus on products and build a team of staff to boost any projects before waiting for the industry to recover. |

This year and next are good for M&A deals, as there are many industries where the prices are already lower than their actual values. Ventures can also take place through stake purchases.

This year and next are good for M&A deals, as there are many industries where the prices are already lower than their actual values. Ventures can also take place through stake purchases.