Viet Nam remains a magnet for FDI: The Banker

Viet Nam is expected to remain a magnet for foreign direct investment (FDI) from sources seeking to diversify their production.

In a recent article released by The Banker, an international financial affairs publication owned by The Financial Times, Viet Nam weathered the COVID-19 pandemic better than most south-east Asian economies.

The nation's GDP growth hit 8 percent in 2022, up from a low base, and is projected to reach 6.3 percent in 2023, according to World Bank estimates.

The government managed to keep the economy ticking over without resorting to massive relief programs that would have raised public debt. Public debt has, in fact, fallen from 44 percent of GDP in 2018 to about 40 percent last year-thanks in part to a repositioning of the GDP number in 2019.

Export recovery

According to The Banker, Viet Nam has a two-pronged economy. There is the export-led economy, fueled mainly by the FDI that started to pour into Viet Nam a decade ago, attracted by the low labor costs, a youthful population of 100 million and an open economy with 15 free trade agreements.

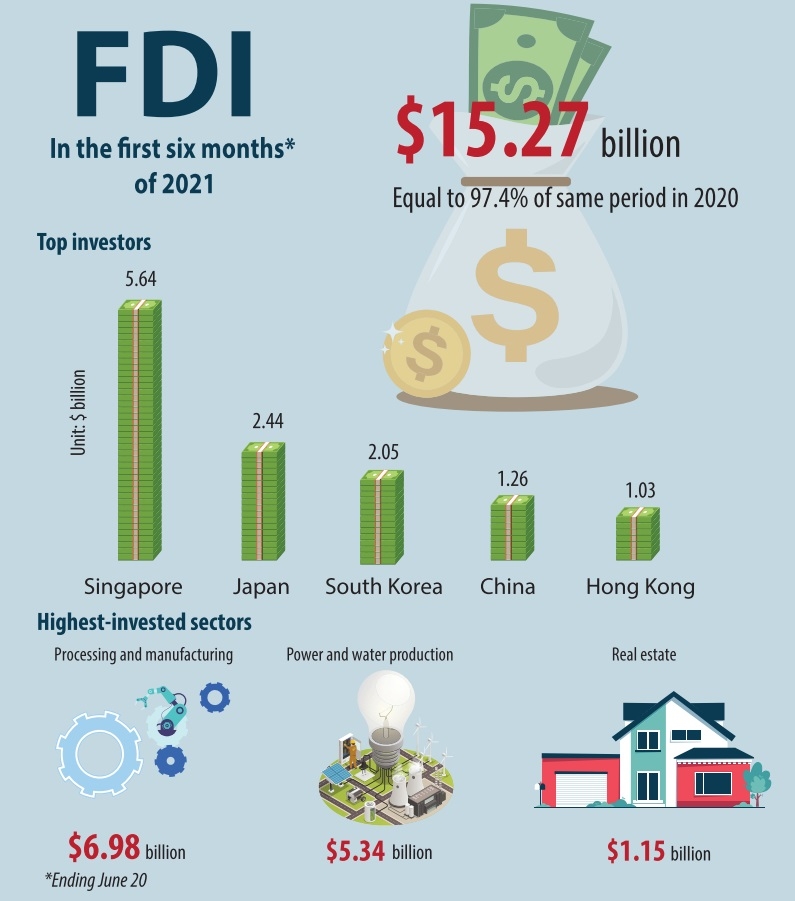

In 2022, FDI disbursements reached US$22.4 billion, helping to fuel exports of US$371.8 billion and a US$11 billion trade surplus. Exports to the U.S. alone reached US$109.4 billion (up 13.6 percent), with a trade surplus of US$94.9 billion (up 17 percent).

According to a 2019 poll conducted by the Japan External Trade Organization, around 40 percent of the Japanese firms looking to shift their overseas production cited Viet Nam as their preferred choice.

Even Chinese companies, especially those in the supply chain clusters for the electronics sector, have been shifting their production to Viet Nam.

The Ministry of Planning and Investment's Foreign Investment Agency (FIA) announced that FDI stood at US$8.88 billion in the first four months of 2023, equivalent to just 82.1 percent compared to the same time last year.

Over 750 new projects were granted investment registration certificates in the same period, with total registered capital of over US$4.1 billion, up 65.2 percent in the number of projects and up 11.1 percent on-year in terms of capital.

The adjusted capital of almost 386 ongoing projects stood at about US$1.66 billion, up 19.5 percent on-year in number but down 68.6 percent in capital terms.

There were approximately 1,044 capital contributions and share purchases as of April 20, equivalent to US$3.1 billion, showing an increase of 70.4 percent over the same period last year.

In addition to the decrease in FDI, the country's disbursed capital also saw a slight decline of 1.2 percent to US$5.85 billion.

Viet Nam's trade with the rest of the world totaled US$210.79 billion in the first four months this year, a decline of 13.6 percent against the same period last year, reported the General Statistics Office (GSO).

Of the above figure, export turnover fell by 11.8 percent to US$108.57 billion while import value dropped by 15.4 percent to US$102.22 billion, resulting in a trade surplus of over US$6 billion.