Vietnam tasked with gaining FDI edge

Boosting both the quality and quantity of foreign investment is being called an imperative for Vietnam as it attempts to improve on 2023 results so far.

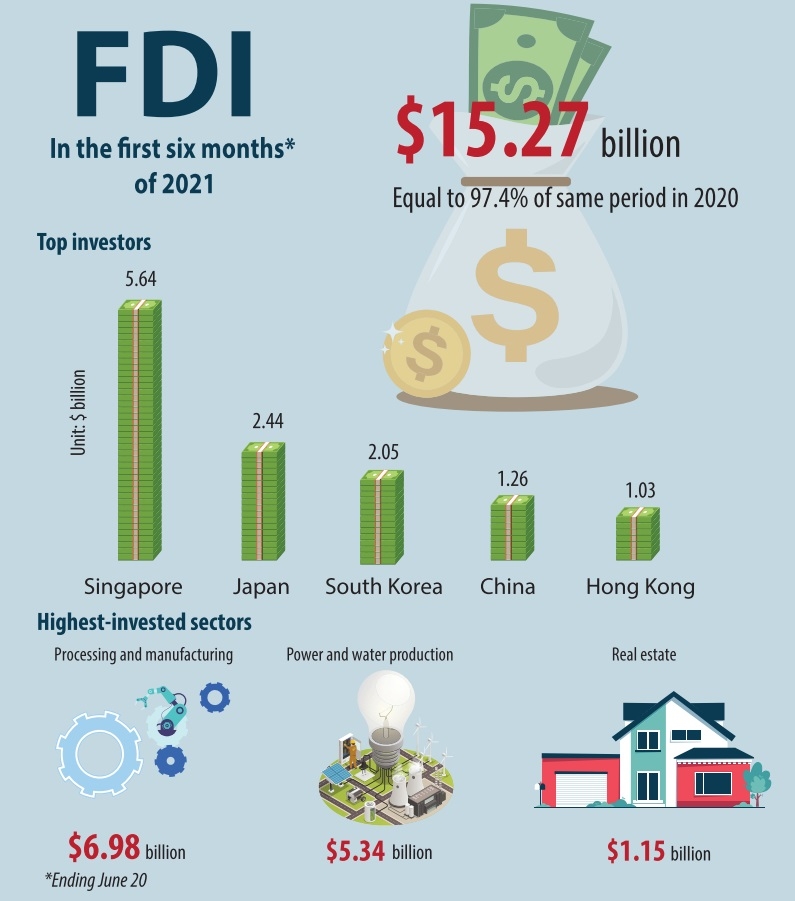

According to the Ministry of Planning and Investment’s Foreign Investment Agency (FIA), accumulatively as of May 20, total foreign direct investment (FDI) inflows into Vietnam reached $10.86 billion, a drop of 7.3 per cent on-year, the fall is getting smaller than in previous months. Of this, newly registered capital was $5.26 billion, up 27.8 per cent on-year; additionally registered capital was $2.28 billion, down 59.4 per cent; and capital contribution and share purchase $3.32 billion, up 67.2 per cent.

Do Nhat Hoang, FIA director-general, said that the rise of newly registered investment in the first five months is much higher than that in the first four months (11 per cent). The number of newly registered projects in the first five months also soared sharply on-year (66.4 per cent) to over 960 projects.

“The growth rate of the number of new projects confirms that small- and medium-sized foreign investors continue to believe in Vietnam’s business environment,” said Hoang.

In an updated report for May, the World Bank acknowledged the drop in FDI inflows into Vietnam, including disbursed capital in recent months. However, this may stem from investor caution due to global uncertainties, it reported.

Experts from RMIT University said that there is a trend of investors looking for opportunities closer to home, in an attempt to shorten supply chains.

“Some countries such as South Korea and Japan, the United States, and some countries in the EU are trying to limit investment overseas by reducing corporate income tax and giving incentives for funding at home to recall their investment overseas. This adds up to more challenges for Vietnam in attracting FDI,” said Daniel Borer from RMIT Vietnam’s Business School.

“Attracting FDI simply via cheap labour is not the solution for quality FDI that the government announced to pursue in its 2018-2023 strategy. Instead, the attractiveness needs to be founded on other aspects rather than simply low wages,” he added.

Vietnam’s five-month disbursed FDI is estimated at $7.56 billion, a dip that has improved compared to the early months of the year.

“Despite a general trend of slowing down, the situation is gradually getting better. The slowdown in attracting FDI is not caused by Vietnam losing competitive advantage,” Hoang said.

Specifically, Vietnam’s central region has become the destination of numerous leading foreign investors. In May, Southeast Nghe An Economic Zone Management Authority handed over an investment certificate for Foxconn’s $100 million factory in WHA Industrial Zone 1, manufacturing wireless headphones, connecting wires, wireless chargers, speakers, and ports.

Besides that, the Luxshare-ICT electronic components factory ($140 million), Goertek’s factory for manufacturing electronic products, network equipment, and multimedia audio products ($500 million), Everwin Precision Vietnam’s electronic component manufacturing facility ($199.8 million), and Ju Teng’s auto parts and electronics factory ($200 million) are urgently expanding or setting up new facilities in Vietnam.

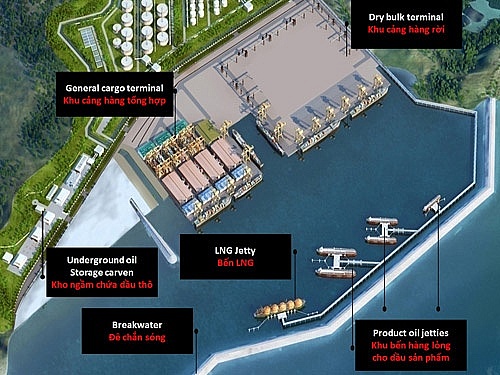

PETMAL Oil Holdings Group of Malaysia has worked with Phu Yen People’s Committee to invest in an oil refinery project in South Phu Yen Economic Zone, with the investment capital expected at $2 billion over 500 hectares; while Germany’s PNE Group proposed Binh Dinh People’s Committee to fund an offshore wind power project with a capacity of 2,000MW, and capital of $4.6 billion.

Noting that competition in FDI mobilisation is getting fierce, Michael Kokalari, chief economist of VinaCapital, outlined the risk factors for Vietnam’s inflows.

“Vietnam may be losing its competition in attracting FDI compared to India, Malaysia, and Indonesia, and may also be less attractive due to the new global minimum tax policy,” Kokalari warned.

Late last month, Prime Minister Pham Minh Chinh issued a directive on tasks and solutions to improve the efficiency of FDI. A series of actions have been assigned to ministries, agencies, and localities such as speeding up planning; preparing stronger conditions for FDI attraction; and improving the performance of promotional activities.

|

Michele Wee - CEO, Standard Chartered Bank (Vietnam) Vietnam has ambitions to be a regional centre and to be a major player in global supply chains and international trade. This has accelerated Vietnam’s investment policies to encourage investments into the country. In terms of demographics, Vietnam has a large labour pool of young and educated workforce that are still comparatively low in costs, and continued education is important. Secondly, the Vietnamese government is progressive and open, dedicated to commerce and sustainable growth, review of global standards and ensure Vietnam’s laws, regulations and governance models are open and transparent to meet these standards. Next, fortifying and optimising the multiple free trade agreements Vietnam has will encourage and support continued integration with global trade and modern supply chains. Finally, political and policy stability should not be underestimated and is a key consideration for global investors. Vietnam’s commitment to be net-zero by 2050 will attract the right investments into our country and also strengthen our product offerings and supporting exports. Furthermore, for investors looking at Vietnam’s market potential, the affluent and emerging affluent class is increasing rapidly, and this in itself makes the domestic market a very attractive and viable market for revenue growth. |