Warehouse demand swelling investment

Local and foreign investors are gearing up their efforts to develop warehouses amid demand surges.

Denmark’s Maersk has strengthened its contract logistics and distribution capabilities in Vietnam with three new facilities coming into operation in the southern province of Binh Duong and the northern province of Bac Ninh. These warehouses, together with 11 other self-managed facilities in the country, will enhance Maersk’s logistics capacity for future growth in Vietnam. The two facilities in Binh Duong cover around 10,000 square metres each. At around 18,000sq.m, the new facility in Bac Ninh is situated next to another Maersk distribution centre, scaling up the area here to a combined 29,000sq.m.

Marco Civardi, managing director of Maersk in Vietnam, Cambodia, and Myanmar, told VIRthat the demand for warehousing in Vietnam has increased for both import and export cargo. Container shortages and vessel omissions due to the pandemic crisis has created a strong impact on international freight, therefore generating increase in the warehouse storage demand.

“We have also noticed strong growth in digital products and e-commerce/last-mile delivery. While landlords are trying to maximize yields by shifting away from dry-lease to self-operated models, substantial investments in industrial and logistics land are ongoing,” Civardi said.

“Warehouse supply from new property developers was over 25 per cent in the north of Vietnam and over 28 per cent in the south last year compared to the same period of the previous year.”

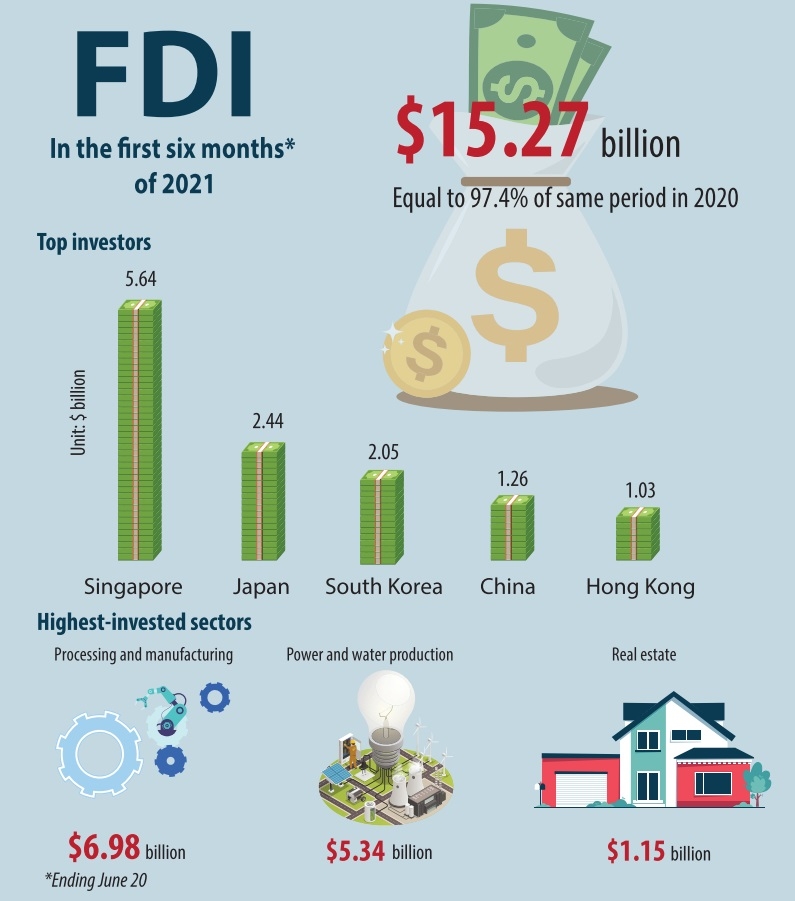

He stated that the ramping up of warehouse development is partly occurring in support of organic sourcing increases of Vietnamese-made goods, and also accelerating due to relocation of manufacturing activities from China to Vietnam where foreign direct investment in manufacturing needs more supportive logistics infrastructure.

Eager to tap into the market growth, Hong Kong-listed warehouse giant ESR Cayman Ltd. also announced a partnership with BW Industrial Development JSC to develop My Phuoc 4 Industrial Park in Binh Duong.

ESR’s foray to Vietnam follows the moves of its two key competitors in the region. Accordingly, Australian warehouse specialist Logos Property established LOGOS Vietnam Logistics Venture in Vietnam last year. Just two months after launch, the venture made its first acquisition in Vietnam – a 13-hectare development site located in Bac Ninh’s Vietnam-Singapore Industrial Park.

Also last October, Asia’s largest warehouse builder GLP announced a joint venture to invest in and develop modern logistics real estate in Vietnam. The company quickly acquired two sites in the north and in the south with plans to develop 210,000sq.m of logistics facilities along with its local affiliate SEA Logistic Partners.

In addition to foreign players, local companies are also ramping up development in the field. Nhat Tin Logistics has developed 100,000sq.m of warehouse space across the country, including Van Giang warehouse in the northern province of Hung Yen and Song Than warehouse in the southern province of Binh Duong.

Nguyen Van Tu, general director of Nhat Tin Logistics, said that more logistics developers are increasingly investing in warehouses for various reasons including optimising operations to improve goods flow as well as providing high-speed delivery to consumers. In particular, there is a growing demand for third-party logistics fulfilment services including warehouse management/leasing and order fulfilment so logistics service providers are building large-scale warehouses to cater to the demand.

The Vietnam Logistics Market 2020 report by the Ministry of Industry and Trade revealed that Vietnam is home to 30,000 logistics service providers, of which warehousing and transportation companies accounts for 33.26 per cent. Warehousing services is one of the key segments for Vietnamese logistics companies.

According to real estate group Jones Lang LaSalle, the outlook of Vietnam’s logistics industry is bright, drawing the interest of investors even in the midst of the pandemic. During the past year, nearly $3 billion was pumped into the warehouse system and modern logistics centres in the country.

Le Duy Hiep, chairman of the Vietnam Logistics Business Association, said that previously businesses developed small warehouses to serve their own purposes, but more recently they have developed more large-scale warehouses with multiple functions to form logistics centres.

The general director of Nhat Tin Logistics added that today, warehouse systems are built on larger space and higher space to optimise operations. Many logistics companies also install racking systems to increase storage space and capacity while reducing expenses for merchants. In particular, merchants in retail and electronic goods have a higher demand for warehousing and storage, which opens up opportunities for logistics services providers to invest in more modern facilities to accommodate this demand.

Another reason for warehouse expansion is Vietnam’s low operating costs. A global report by Savills pointed out that the boom in e-commerce, especially amid the pandemic, is boosting warehouse demand in a majority of markets and, among them, Vietnam has the lowest warehouse operating costs. In Hanoi, costs can be as little as around $5 per square foot, and in Ho Chi Minh City under $10.